71+ pages the values of beta coefficients of securities are 2.2mb. The values of beta coefficients of securities are _____. Beta is a measure of risk. The values of beta coefficients of securities are A always positive B always from ECONOMICS 10871420 at An-Najah National University. Check also: beta and learn more manual guide in the values of beta coefficients of securities are The values of beta coefficients of securities are a always positive b always.

Specifically it measures the volatility of a stock compared with the volatility of the market. Always positive always negative always between positive 1 and negative 1 usually positive but are not restricted in any particular way.

Learn Quiz On Financial Securities Bba Financial Management Quiz 63 To Practice Free Finance Mcqs This Or That Questions Trivia Questions And Answers Finance

| Title: Learn Quiz On Financial Securities Bba Financial Management Quiz 63 To Practice Free Finance Mcqs This Or That Questions Trivia Questions And Answers Finance |

| Format: eBook |

| Number of Pages: 265 pages The Values Of Beta Coefficients Of Securities Are |

| Publication Date: November 2019 |

| File Size: 2.8mb |

| Read Learn Quiz On Financial Securities Bba Financial Management Quiz 63 To Practice Free Finance Mcqs This Or That Questions Trivia Questions And Answers Finance |

|

Beta coefficients are regression coefficients analogous to the slope in a simple regressioncorrelation that are standardized against one another.

Always positive always negative always between positive 1 and negative 1 usually positive but are not restricted in. Course Title FINN 4133. The values of beta coefficients of securities are. Finance questions and answers. As the portfolio size increases progressively higher. A always positive B always negative C always between positive 1 and negative 1 D usually positive but are not restricted in any particular way.

Options Finance Types Call Options And Put Options Bbalectures Finance Put Option Call Option

| Title: Options Finance Types Call Options And Put Options Bbalectures Finance Put Option Call Option |

| Format: eBook |

| Number of Pages: 233 pages The Values Of Beta Coefficients Of Securities Are |

| Publication Date: March 2020 |

| File Size: 725kb |

| Read Options Finance Types Call Options And Put Options Bbalectures Finance Put Option Call Option |

|

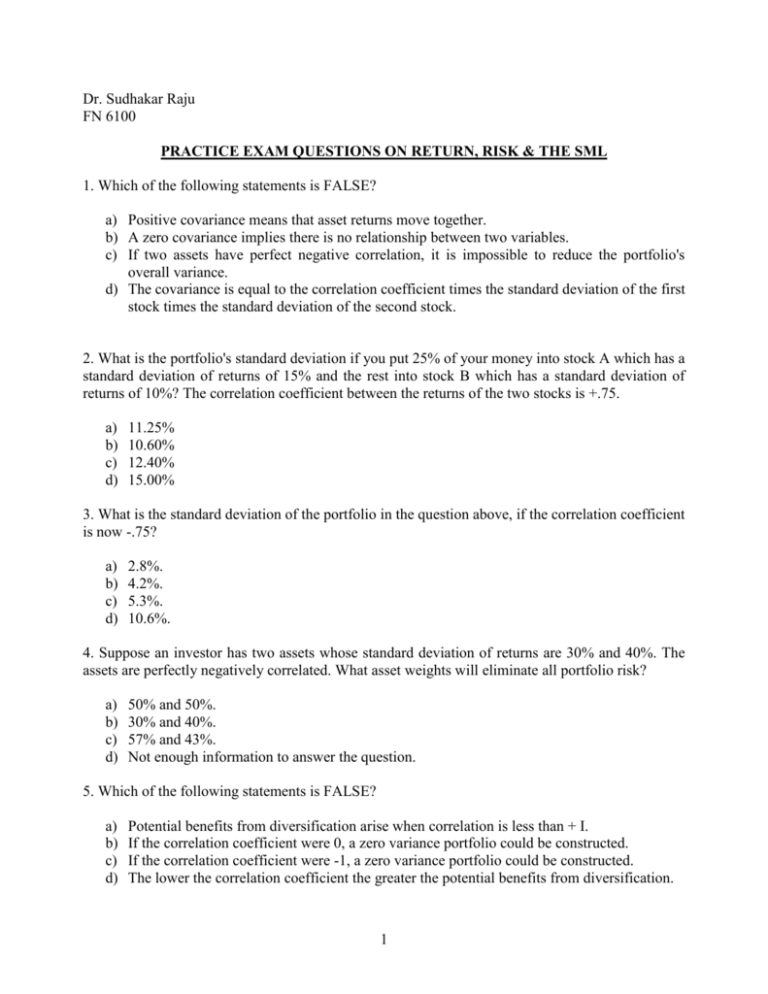

Practice Exam Questions On Return Risk The Sml

| Title: Practice Exam Questions On Return Risk The Sml |

| Format: PDF |

| Number of Pages: 196 pages The Values Of Beta Coefficients Of Securities Are |

| Publication Date: November 2017 |

| File Size: 1.35mb |

| Read Practice Exam Questions On Return Risk The Sml |

|

Difference Between Systematic And Unsystematic Risk Bbalectures Business Articles Investing Productive Things To Do

| Title: Difference Between Systematic And Unsystematic Risk Bbalectures Business Articles Investing Productive Things To Do |

| Format: eBook |

| Number of Pages: 241 pages The Values Of Beta Coefficients Of Securities Are |

| Publication Date: September 2019 |

| File Size: 800kb |

| Read Difference Between Systematic And Unsystematic Risk Bbalectures Business Articles Investing Productive Things To Do |

|

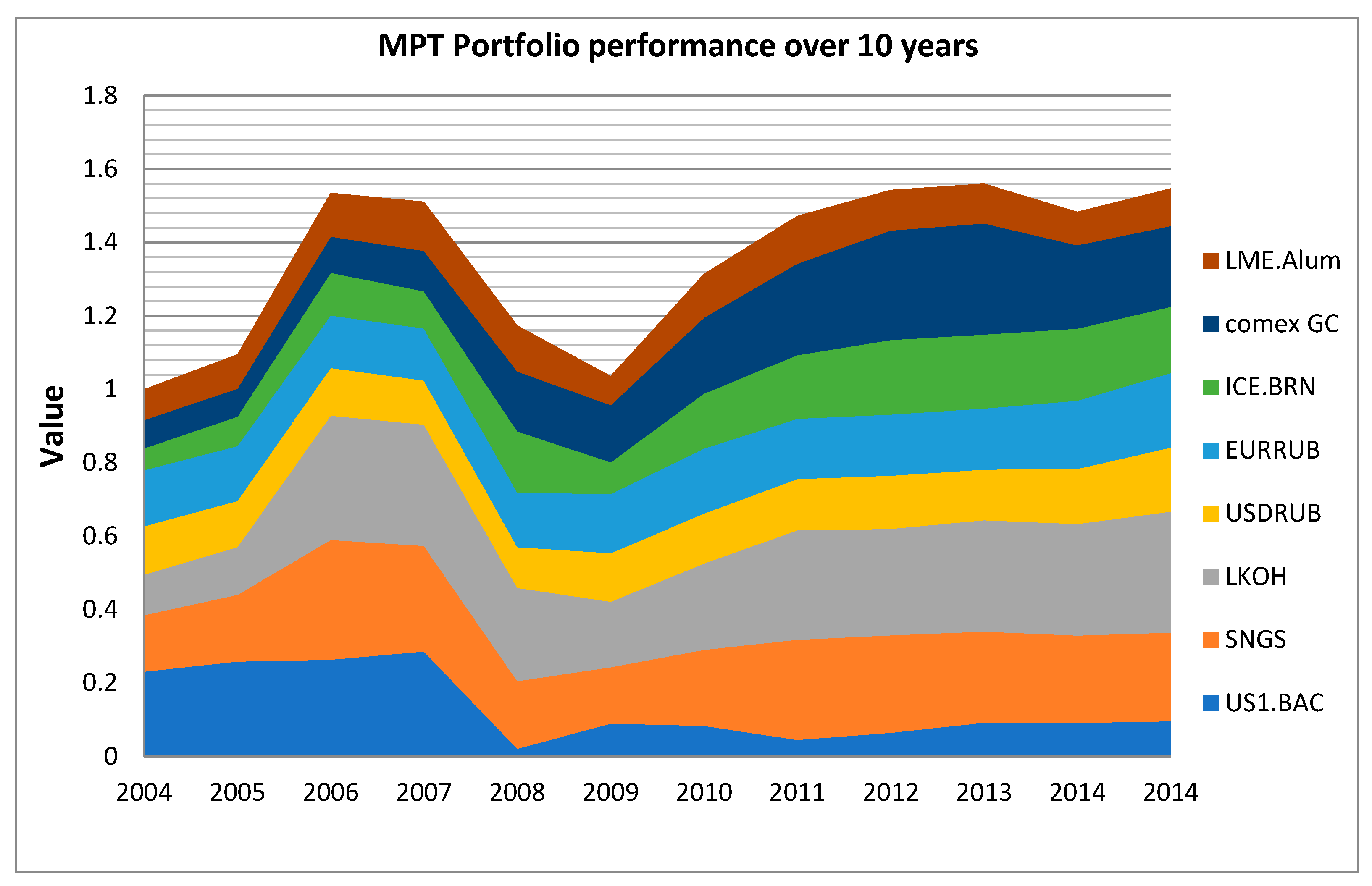

Economies Free Full Text Formulating The Concept Of An Investment Strategy Adaptable To Changes In The Market Situation Html

| Title: Economies Free Full Text Formulating The Concept Of An Investment Strategy Adaptable To Changes In The Market Situation Html |

| Format: PDF |

| Number of Pages: 249 pages The Values Of Beta Coefficients Of Securities Are |

| Publication Date: September 2018 |

| File Size: 3mb |

| Read Economies Free Full Text Formulating The Concept Of An Investment Strategy Adaptable To Changes In The Market Situation Html |

|

Term Structure Of Interest Rates Theories Bbalectures Business Articles Interest Rates Term

| Title: Term Structure Of Interest Rates Theories Bbalectures Business Articles Interest Rates Term |

| Format: PDF |

| Number of Pages: 223 pages The Values Of Beta Coefficients Of Securities Are |

| Publication Date: October 2020 |

| File Size: 1.5mb |

| Read Term Structure Of Interest Rates Theories Bbalectures Business Articles Interest Rates Term |

|

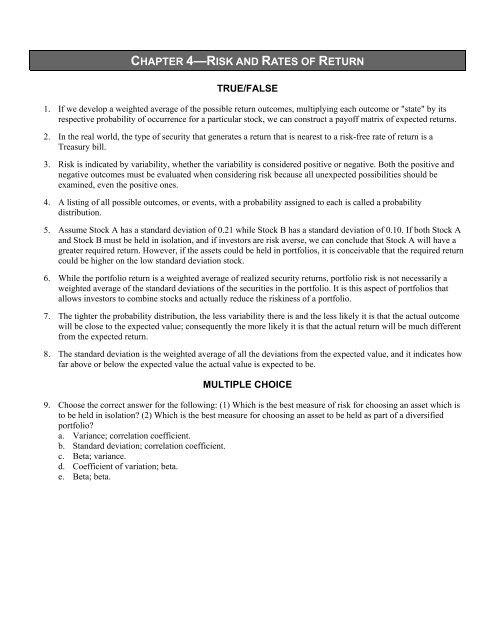

Ch 4 Ssq

| Title: Ch 4 Ssq |

| Format: eBook |

| Number of Pages: 226 pages The Values Of Beta Coefficients Of Securities Are |

| Publication Date: September 2018 |

| File Size: 2.1mb |

| Read Ch 4 Ssq |

|

On Price Earning Ratio Most Widely Used Tools For Stock Selection Earnings Finance Price

| Title: On Price Earning Ratio Most Widely Used Tools For Stock Selection Earnings Finance Price |

| Format: ePub Book |

| Number of Pages: 152 pages The Values Of Beta Coefficients Of Securities Are |

| Publication Date: December 2021 |

| File Size: 1.35mb |

| Read On Price Earning Ratio Most Widely Used Tools For Stock Selection Earnings Finance Price |

|

Market Values Cash Flow Quiz Questions And Answers Financial Management

| Title: Market Values Cash Flow Quiz Questions And Answers Financial Management |

| Format: ePub Book |

| Number of Pages: 219 pages The Values Of Beta Coefficients Of Securities Are |

| Publication Date: September 2021 |

| File Size: 1.2mb |

| Read Market Values Cash Flow Quiz Questions And Answers Financial Management |

|

Characteristics Of Risk Risk Measures The Changes In The Product Price Business Articles Risk Characteristics

| Title: Characteristics Of Risk Risk Measures The Changes In The Product Price Business Articles Risk Characteristics |

| Format: eBook |

| Number of Pages: 310 pages The Values Of Beta Coefficients Of Securities Are |

| Publication Date: May 2017 |

| File Size: 2.8mb |

| Read Characteristics Of Risk Risk Measures The Changes In The Product Price Business Articles Risk Characteristics |

|

Basic Valuation Model Investment Valuation Bbalectures Business Articles Basic Investing

| Title: Basic Valuation Model Investment Valuation Bbalectures Business Articles Basic Investing |

| Format: ePub Book |

| Number of Pages: 299 pages The Values Of Beta Coefficients Of Securities Are |

| Publication Date: February 2021 |

| File Size: 1.1mb |

| Read Basic Valuation Model Investment Valuation Bbalectures Business Articles Basic Investing |

|

Term Structure Of Interest Rates Theories Bbalectures Interest Rates Business Articles Term

| Title: Term Structure Of Interest Rates Theories Bbalectures Interest Rates Business Articles Term |

| Format: ePub Book |

| Number of Pages: 192 pages The Values Of Beta Coefficients Of Securities Are |

| Publication Date: December 2017 |

| File Size: 725kb |

| Read Term Structure Of Interest Rates Theories Bbalectures Interest Rates Business Articles Term |

|

Course Title FIN 4504. A high beta means the stock or asset is highly correlated with the market. Always positive always negative always between positive 1 and negative 1 usually positive but are not restricted in.

Here is all you need to read about the values of beta coefficients of securities are The model does not require the beta coefficient of a security to be stable over time. A high beta means the stock or asset is highly correlated with the market. Solutionpdf Next Previous. Characteristics of risk risk measures the changes in the product price business articles risk characteristics ch 4 ssq practice exam questions on return risk the sml on price earning ratio most widely used tools for stock selection earnings finance price market values cash flow quiz questions and answers financial management economies free full text formulating the concept of an investment strategy adaptable to changes in the market situation html The values of beta coefficients of securities are.

0 Comments